As extreme weather events intensify worldwide, safeguarding property and infrastructure is no longer optional—it has become a necessity. ESG VISA is a next-generation platform designed to help property owners, facility managers, and city planners transform climate risk into a manageable process. By using smart data analysis and useful planning tools, ESG VISA helps people involved in property and city management create communities that can withstand climate challenges and keep important assets safe.

At the heart of ESG VISA is its blockchain-verified digital identity for every property and asset. This secure, tamper-proof profile records critical details such as structural specifications, energy and water performance data, drainage capacity, and maintenance history. When connected to Internet of Things (IoT) sensors, each property effectively gains a “digital twin,” continuously updated with real-time data about environmental conditions and equipment performance. This integration allows ESG VISA to detect early warning signs—for instance, when a drainage pump shows signs of failure or soil moisture levels reach a critical threshold—and automatically alert facility managers so they can act before a problem escalates into a disaster.

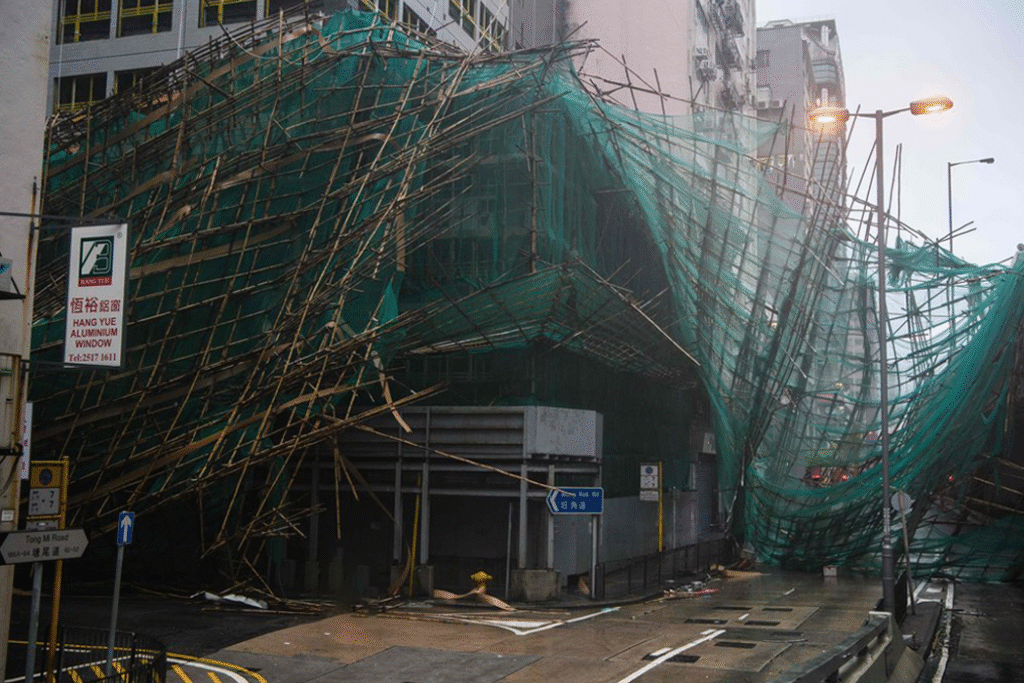

When an extreme weather event such as typhoon Ragasa, ESG VISA takes proactive disaster management to the next level. The platform analyzes weather forecasts alongside the property’s specific risk profile and issues early alerts tailored to each asset’s vulnerabilities. It also generates automated action plans, reminding facility teams to check pumps, test backup generators, and clear drainage channels, while prioritizing the most critical systems. After the event, ESG VISA helps speed up recovery by compiling a verified digital damage report that combines sensor data with user-submitted evidence. This trusted documentation simplifies the process of filing insurance claims and applying for emergency funding, significantly reducing delays and financial stress.

The benefits of ESG VISA extend beyond crisis response. By providing verifiable ESG grading, compliance reports, and consultation services on green finance, the platform enables property owners to demonstrate their commitment to sustainability and resilience. This opens doors to green financing opportunities and grants, potentially lowering insurance premiums while strengthening the market value and reputation of their assets. More importantly, it protects the well-being of residents by minimizing service disruptions, improving safety, and ensuring that communities recover faster when disasters strike.

In this way, ESG VISA transforms climate risk management from a reactive and costly challenge into a proactive, data-driven strategy. By equipping property owners and city planners with the insights and tools they need to prepare for and respond to extreme weather events, ESG VISA turns climate resilience into a practical and achievable goal. This leads to a future in which communities experience fewer losses, recover at a faster pace, and become stronger and more sustainable as they progress.

ESG VISA is a smart compliance and sustainability platform that transforms real-time building data into actionable ESG insights. By combining IoT monitoring, AI-driven analytics, and blockchain-secured records, it makes environmental compliance effortless, transparent, and value-adding for property owners and managers.

G/F SHOP14 GODFREY CENTRE 175-185 LAI CHI KOK ROAD MONGKOK KLN

ROOM 314, 3RD FLOOR,NO. 18, YUEXING 1ST ROAD, NANSHAN DISTRICT, SHENZHEN

(+852)2123 9308

(+852) 68360888

Enter your email to get your free copy of the Guide.

ESGVISA ©2025 All Right Reserved