The real estate sector has reached a tipping point: deep energy retrofits and climate resilience are no longer optional—they are financial imperatives. ESG VISA’s Retrofitting Framework transforms building data into risk-weighted investment priorities, using a 100-point quantitative scoring system across Environmental, Governance, and Social pillars.

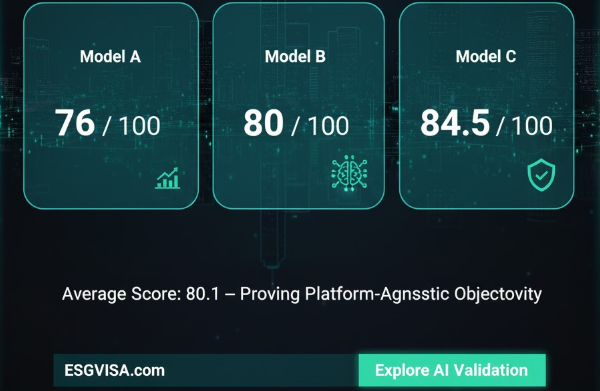

To ensure reliability, the framework was stress-tested across three leading large language models (anonymized). The identity of the company has also been anonymized to protect the privacy of its internal sustainability data. Scores ranged narrowly from 76 to 84.5, demonstrating consistent, platform-agnostic results investors can trust.

Not all retrofits are equal. ESG VISA uses a Risk-Adjusted Multiplier to rank sites, targeting buildings with the largest energy gaps or lowest compliance first, maximizing OpEx savings and reducing ESG risk.

ESG VISA measures energy performance gaps, embodied carbon, decarbonization roadmaps, water/waste efficiency, contractor compliance, and occupant well-being. It also leverages IoT for real-time data, AI for predictive analytics, and blockchain for immutable proof—turning compliance into a competitive advantage.

Industry Alignment: Supports 2026 trends like embodied carbon reporting and net-zero accountability, helping avoid liquidity risks for non-green assets.

In an era where retrofitting momentum is accelerating—driven by regulatory shifts and tenant demand for resilient, efficient buildings—ESG VISA provides the actionable intelligence needed for long-term resilience and value creation.